***PUBLIC NOTICE***

Notice to the Hart County Property Owners and Occupants

In accordance with O.C.G.A. 48-5-264.1, please be advised

that the Hart County Appraisal Staff may be visiting your

property to review your parcel information concerning an

appeal filed, return filed, construction of new improvement

or addition, review of parcel, and/or conservation use application.

The field appraiser from our office will have photo identification

and will be driving a marked County Vehicle.

If you have any further questions, please call our office

at the number listed at the top of this page.

PROPERTY TAX RETURNS

Property tax returns can be filed with the Hart County Board of Tax Assessors between

January 1 and April 1 of each year. This can be helpful to the property owner if there are

changes. A tax notice will be sent out each year by April 15. If there are corrections

they can be made at that time.

returns.

HOMESTEAD EXEMPTIONS

A Person filing for Homestead Exemption must live in the home, and the home

is considered their legal residence for all purposes. Persons that are away from

their home of health reasons will not be denied homestead exemption. A family member

or friend can notify the tax receiver or tax commissioner and the homestead exemption

will be granted. (O.C.G.A. § 48-5-40) Application for homestead exemption must

be filed with the tax assessor's office.

TO RECEIVE HOMESTEAD EXEMPTION FOR THE CURRENT TAX YEAR

A Homeowner can file for an application for homestead exemption for their home and land

any time during the prior year up to the deadline for filing returns. To receive the

homestead exemption for the current tax year, the homeowner must have owned the property

on January 1 and filed the homestead application by the same date property tax

returns are due in the county.

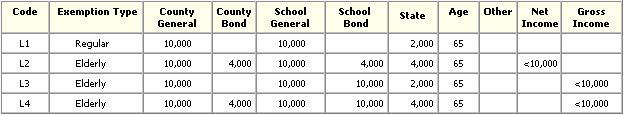

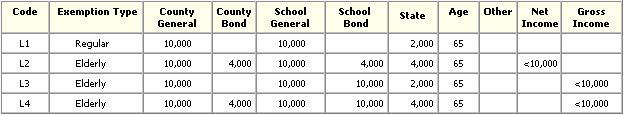

The following

local homestead exemptions are offered in this county:

AD VALOREM TAX PAYMENTS

Taxes are normally due in this county by December

20 of each year but the law allows taxpayers 60 days from the

date of mailing before interest may be charged. Ad valorem taxes

are collected by the Tax Commissioner.

VALUATION APPEALS

If the assessors disagree with the taxpayer's returned

value, they will change the value and a change of assessment notice

will be sent to the taxpayer. If the taxpayer wishes to appeal

the change, the appeal must be sent to the Board of Tax Assessors

and postmarked no later than 45 days from the date of the change

of assessment notice. For more information on the procedure to

file an appeal please call the office.

AD VALOREM TAX REFUNDS

If a taxpayer discovers they have paid taxes that

they believe were illegal or erroneous, they may request a refund

within 3 years of the date of payment. The claim for refund should

be filed in writing with the county governing authority within

three years after the date of payment. For more information on

the procedure to file a claim for refund please call the office.

MOBILE HOME TAXATION

Mobile Home

Location Permits: Taxpayers locating a mobile home in Hart County

must apply to the Tax Commissioner for a location permit within

30 days of permanent placement of the home in the county and then

annually thereafter between January 1 and May 1. Mobile homes

that are temporarily located in the county and are owned by a

business that is not located in the county should notify the Board

of Tax Assessors of their presence to avoid being cited for failure

to apply for the location permit.

Mobile Home

Returns: Owners of mobile homes that are located in the county

on January 1 must return the mobile home for taxation to the Tax

Commissioner on or before May 1 of each year at the same time

they apply for the location permit. For more information on mobile

homes please call the Tax Assessors or the Tax Commissioner.

INTANGIBLE RECORDING

Every holder of a long-term note secured by real estate

must have the security instrument recorded in the county where

the real estate is located within 90 days. In Hart County the

Tax Commissioner is responsible for collecting intangible recording

tax.

The tax for

recording the note is at the rate of $1.50 for each $500.00 or

fractional part of the face amount of the note. For more information

on the intangible recording tax please contact the Tax Comissioner.